Introduction to Dividends and AVGO Stock

Dividends are payments made by a corporation to its shareholders, typically derived from its profits. These payments act as a way for companies to distribute a portion of their earnings back to investors, providing them with a direct return on their investment. In the stock market, dividends can be an essential factor for investors, particularly for those seeking a steady income stream. Companies that consistently pay dividends are often viewed as financially stable and capable of generating sufficient revenue to reward their shareholders, which can enhance their attractiveness as long-term investments.

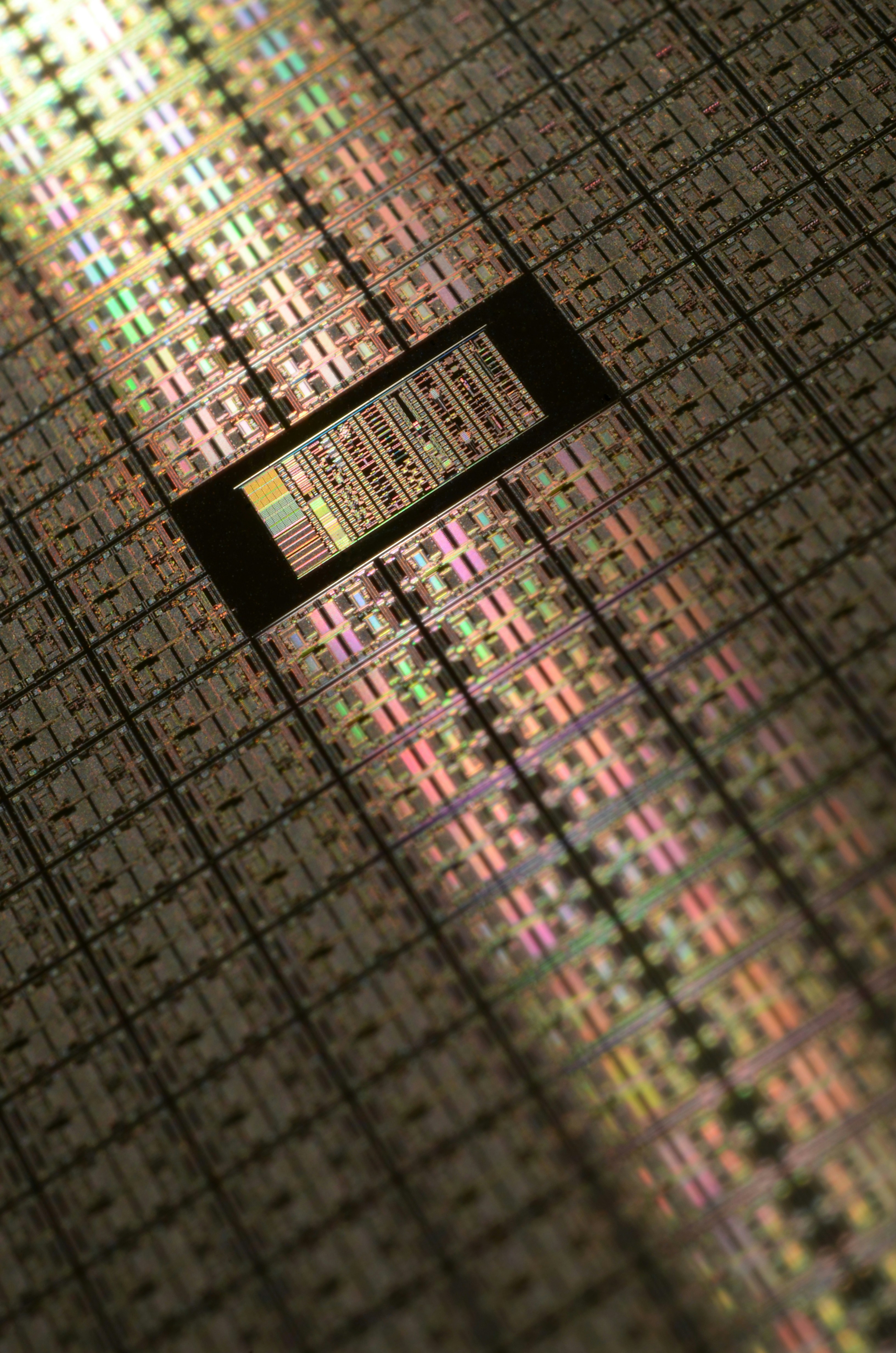

Broadcom Inc. (AVGO) is one such company that is well-regarded for its dividend payments. As a leading semiconductor and infrastructure software solutions provider, Broadcom has a business model grounded in innovation and technology. The company develops a wide array of products that range from wireless communication chips to enterprise software solutions, positioning itself in various high-growth markets such as cloud computing, data centers, and the Internet of Things (IoT).

Investors are particularly drawn to AVGO stock due to its history of consistent dividend growth. Broadcom has established a reputation for returning capital to its shareholders, which is appealing to income-focused investors. The company’s commitment to dividends reflects its strong operational performance and robust cash flow generation. Additionally, the management’s strategy of using free cash flow for both dividend payments and strategic acquisitions contributes to its attractiveness in the technology sector. Overall, the combination of a solid business model and an unwavering commitment to returning profits to shareholders makes AVGO stock an appealing choice for investors interested in dividends.

History of AVGO Dividends

The historical performance of Broadcom Inc. (AVGO) dividends reveals a strong commitment to returning value to shareholders. Broadcom initiated its dividend payments in 2016, marking a significant milestone in the company’s history as it transitioned to a publicly traded corporation. The introduction of dividends was a strategic decision, aligning with the company’s goal of providing long-term value in an increasingly competitive technology sector.

Since that time, AVGO has consistently increased its dividend payouts, demonstrating a clear trend toward enhanced shareholder returns. The company initially announced a quarterly dividend of $0.51 per share, which reflected its desire to establish a reliable return on investment for its shareholders. Over the past several years, Broadcom has implemented multiple increases in its dividend payouts. As of the end of 2023, the quarterly dividend had grown to $4.60 per share, indicative of a robust annual growth rate that is noteworthy in comparison to industry standards.

To understand the growth trajectory of AVGO dividends, it is essential to recognize its dividend growth rate, which has significantly outpaced many of its peers in the semiconductor industry. By maintaining a steady increase in dividend payments, Broadcom has effectively positioned itself as an attractive option for income-seeking investors. Furthermore, this trajectory highlights the company’s ability to generate strong cash flow, reinforcing its commitment to returning capital to its investors.

Additionally, Broadcom’s dividends have consistently surpassed the industry average, reflecting its financial health and operational efficiency. This solid dividend performance has established a reputation for AVGO as a reliable dividend payer, thereby enhancing its appeal among investors looking for both stability and growth in their investments. Such a commitment underpins Broadcom’s broader corporate strategy, enabling it to remain a strong contender in the dynamic technology landscape.

Current Dividends: Analysis and Figures

As of October 2023, Broadcom Inc. (NASDAQ: AVGO) offers an appealing dividend proposition to its shareholders. The current dividend rate stands at $4.60 per share, distributed on a quarterly basis, thus making the total annual payout approximately $18.40. This results in a dividend yield of around 3.15%, reflecting the company’s robust ability to return value to its stakeholders while maintaining its operational and financial health.

In recent announcements, AVGO stock has demonstrated a consistent commitment to dividend payments. The company has not only maintained its dividend but has also increased it steadily over the years. The latest announcement indicated a 10% increase in the quarterly dividend, underlining Broadcom’s strategy of fueling shareholder confidence and providing a stable income stream. Such decisions are often perceived positively by investors, revealing the management’s ongoing commitment to enhancing shareholder value even amid fluctuating market conditions.

Broadcom’s dividend policy complements its overall financial performance. The company has showcased strong revenue growth, driven by its diverse product portfolio and strategic acquisitions in the semiconductor industry. This growth is reflected in its net income, which has improved significantly, allowing for higher dividend payments while ensuring that the payout ratio remains sustainable. An optimal payout ratio, typically between 30% and 60%, fortifies the company’s ability to invest in future growth opportunities, thereby securing long-term dividends for shareholders.

In summary, AVGO stock’s current dividend rates signify a promising outlook for shareholders, underpinned by the company’s stable earnings and prudent financial management. Investors should remain vigilant, however, as market dynamics can influence future dividend adjustments and overall investment strategies.

Future Prospects and Considerations for Investors

As investors look towards the future of AVGO stock dividends, several critical factors play a significant role in shaping dividend prospects. Broadcom Inc.’s commitment to returning capital to shareholders through consistent dividends is closely linked to its financial stability and overall market conditions. Future dividend growth largely depends on the company’s revenue streams, cost management, and its ability to adapt to rapidly evolving technology sectors.

Market trends are pivotal in understanding how AVGO can sustain its dividend payouts. Recent advancements in semiconductor technology and the expansion of cloud computing services present lucrative opportunities for Broadcom. However, these opportunities are intertwined with market fluctuations and competition. Should the company successfully capitalize on these trends, it may bolster its earnings, allowing for potential increases in future dividends.

Economic conditions also play a vital role in dividend stability. Factors such as inflation rates, interest rates, and consumer spending can directly impact Broadcom’s profitability. A robust economy typically leads to increased demand for technology products, which can translate to higher revenues and sustained or even increased dividend payouts. Conversely, economic downturns could pose risks to maintaining current dividend levels, necessitating a cautious approach for investors.

Furthermore, an assessment of Broadcom’s financial health is essential. This includes evaluating its balance sheet, cash flow positions, and debt levels. A strong financial foundation not only supports dividend payments but also positions the company to navigate potential market volatility more effectively. Investors should take into account Broadcom’s historical dividend growth and its strategic initiatives aimed at enhancing shareholder value.

In essence, current and potential investors must consider a myriad of factors, including market dynamics, economic indicators, and company financials, all of which influence the outlook for AVGO stock dividends. Understanding these elements will aid in making informed investment decisions regarding Broadcom and its future dividend policies.