Introduction to Nokia Stock

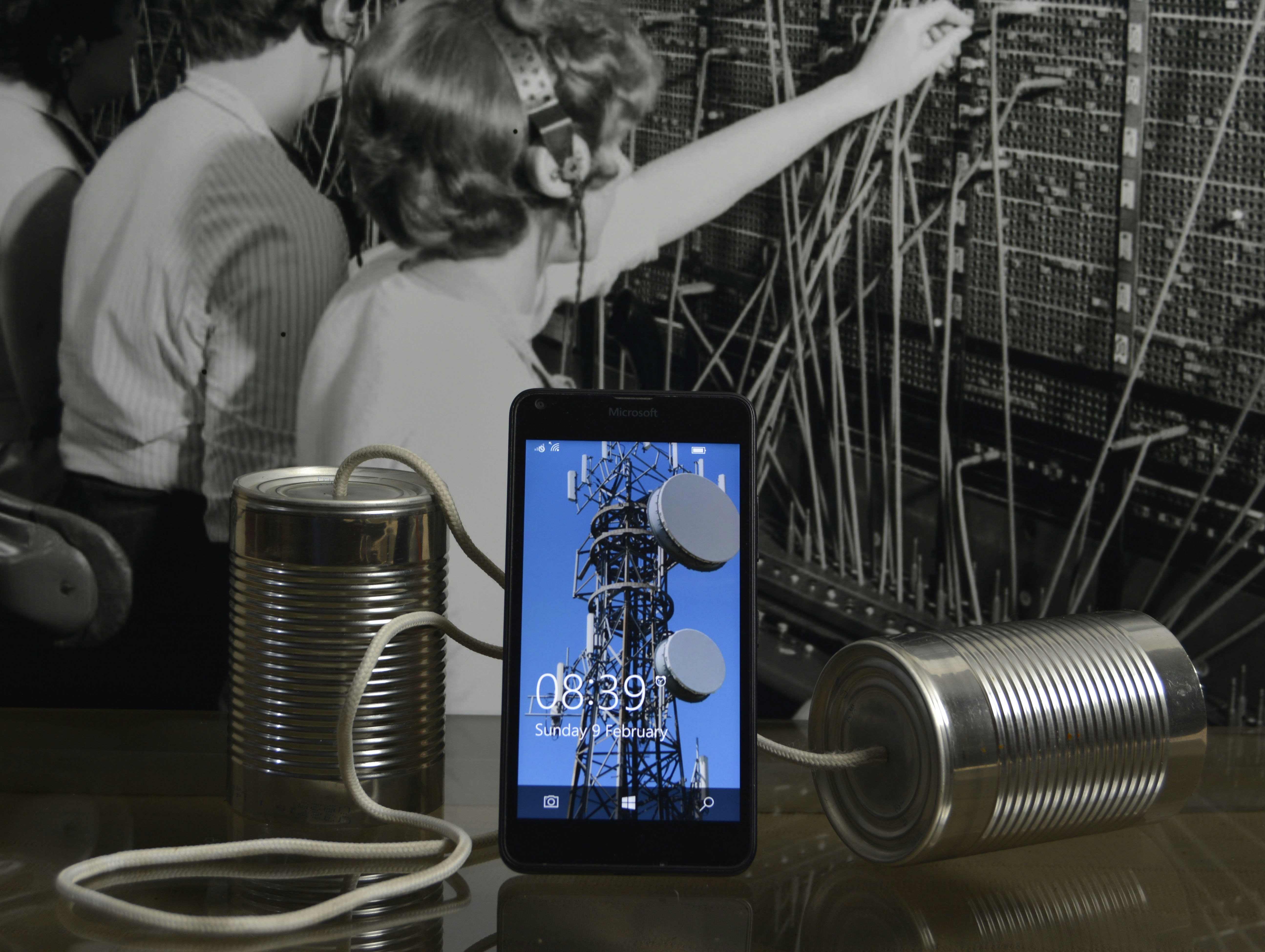

Nokia, founded in 1865, is a storied telecommunications and consumer electronics company based in Finland. Initially established as a wood-pulp mill, the company evolved into one of the leading players in the global telecommunications industry. Over the decades, Nokia has undergone numerous transformations, focusing on various sectors including mobile communication and information technology. Today, it is best known for its robust portfolio of telecom infrastructure and services, particularly in mobile networks and 5G technology.

Nokia’s core business operations primarily revolve around the provision of network infrastructure, technology services, and software solutions for telecommunications companies worldwide. As telecom networks transition from traditional systems to more advanced 5G frameworks, Nokia has positioned itself as a key player, catering to the demands of numerous network operators and service providers. Moreover, Nokia’s commitment to research and development aids in its innovation efforts, solidifying its competitive edge in an increasingly saturated market.

The significance of Nokia stock within the telecommunications sector cannot be understated. As a publicly traded entity on the Helsinki Stock Exchange and the New York Stock Exchange, Nokia stock serves not only as an investment vehicle but also as a benchmark for evaluating trends within the telecommunications and technology industries. Various factors influence Nokia’s stock price, including technological advancements, market competition, changes in consumer demand, and regulatory frameworks that govern the telecommunications landscape. Additionally, macroeconomic indicators and geopolitical events play crucial roles in determining market sentiment surrounding Nokia stock and its potential for future growth.

Recent Trends in Nokia Stock Prices

Over the past few months, Nokia’s stock has exhibited a notable degree of volatility, influenced by various factors ranging from market trends to company-specific developments. As of late 2023, the stock price has reflected significant fluctuations, with periods of both rapid increases and sharp declines. This behavior is indicative of a market that is reacting to a myriad of external and internal factors, including shifts in consumer technology preferences, competitive pressures, and the broader economic environment.

In recent months, Nokia’s stock experienced peaks following positive quarterly earnings reports. For instance, after announcing stronger-than-expected revenue growth, investors responded favorably, resulting in a stock price surge. Conversely, periods of market uncertainty, influenced by changes in technology sector performance or broader economic indicators, led to downturns in Nokia’s stock valuation. An analysis of stock price movements illustrates how closely intertwined Nokia’s financial performance is with macroeconomic conditions and investor sentiment.

Additionally, key milestones such as product launches, strategic partnerships, and technological advancements have directly impacted stock performance. Events like the rollout of 5G technology infrastructure and collaborations with major telecom operators have been particularly influential. Analysts have noted these partnerships as critical for Nokia’s growth, and success in these ventures often translates to increases in stock prices. Furthermore, graphical representations of the stock price trends demonstrate clear correlations with significant announcements and market events, underlining the importance of strategic decisions in influencing investor confidence.

Finally, financial analysts have been cautiously optimistic in their outlook for Nokia stock due to its inherent volatility. They emphasize understanding market conditions that could affect trading patterns in the future, highlighting the need for investors to remain informed and adaptable to ongoing changes in the market landscape. This context provides an invaluable framework for understanding Nokia’s recent stock performance.

Factors Influencing Nokia Stock Performance

Nokia’s stock performance is influenced by a myriad of factors within the telecommunications industry and the broader economic landscape. One of the primary elements affecting Nokia’s share price is the level of market competition. The tech sector is marked by rapid advancements and continuous disruption, making competition from companies such as Ericsson and Huawei significant. If competitors launch innovative solutions or disruptive technologies, it can adversely affect Nokia’s market position and stock performance.

Technological advancements constitute another crucial factor. As the demand for 5G connectivity proliferates around the globe, Nokia’s ability to innovate and deliver cutting-edge telecommunications solutions is vital. The company’s research and development efforts are essential in ensuring that it remains a formidable player in a continually evolving industry. Innovations not only capture consumer interest but also bolster investor confidence, consequently impacting stock performance positively.

Moreover, regulatory challenges can shape market dynamics significantly. As governments enforce stricter regulations regarding data privacy and security, compliance becomes critical for companies like Nokia. Failures in this domain could lead to financial penalties or tarnished reputations, adversely impacting stock prices. Additionally, economic indicators such as inflation rates, interest rates, and overall economic growth affect investor sentiment and can lead to volatility in stock performance.

Nokia’s strategic partnerships play an essential role in cementing its position in the telecommunications landscape. Collaborations with major technology enterprises can yield mutually beneficial outcomes, enhancing product offerings and expanding market reach. Furthermore, comparisons with competitors are critical for investors to gauge Nokia’s performance. Regular assessments of market share and financial metrics against rivals can reveal crucial trends that aid strategic decision-making. By understanding these factors, stakeholders can better navigate the complexities influencing Nokia’s stock performance.

Future Outlook for Nokia Stock

The future outlook for Nokia stock appears to be shaped by a confluence of market trends, technological advancements, and evolving consumer demands. Analysts have identified several factors that could positively influence Nokia’s stock performance in the coming years. One of the most significant drivers is the ongoing investment in 5G infrastructure. As global demand for faster and more reliable telecommunications services rises, Nokia stands poised to play a pivotal role in the rollout and enhancement of these networks. This presents a substantial opportunity for revenue growth and can bolster investor confidence.

Moreover, Nokia’s continued commitment to research and development in areas such as software solutions and Internet of Things (IoT) technologies aligns well with broader market trends. As businesses increasingly integrate IoT devices into their operations, Nokia’s innovations in this space could lead to lucrative partnerships and contracts, further enhancing its market position. Additionally, the company’s restructuring efforts aimed at streamlining operations and focusing on core competencies may provide an added layer of financial stability, crucial for sustaining investor interest.

However, potential threats loom on the horizon. Increased competition from both established players and new entrants in the telecommunications sector could pressure Nokia’s market share and, consequently, its stock price. Furthermore, geopolitical tensions and regulatory challenges in different regions could impact performance and complicate international operations. Investors should remain vigilant regarding these dynamics as they could significantly affect future stock valuations.

For investors contemplating making informed decisions regarding Nokia stock, it is crucial to conduct thorough, ongoing research. Monitoring market trends, while also considering expert forecasts, will provide valuable insights. Evaluating performance metrics and potential shifts in the tech landscape will help inform investment strategies in this evolving sector.