Introduction

In a noteworthy development within the financial realm, William Elsener, the Executive Vice President of Matador Resources, recently engaged in a significant stock purchase amounting to $30,075. This transaction stands as a pivotal moment not only for Elsener but also for Matador Resources and its stakeholders at large. Insider trading activities, such as this one, often generate considerable interest and speculation regarding their implications for company performance and stock market dynamics.

Insider trading remains a critical indicator in the investment community, as it reflects the confidence of company executives and leaders in the organization’s future prospects. By purchasing stocks at this juncture, Elsener’s actions may be interpreted as a signal to investors about the strength and potential growth trajectory of Matador Resources. Such moves may suggest that he perceives the company’s current valuation as attractive or that favorable developments are on the horizon, which could influence the perceptions of other investors and stakeholders.

Analyzing the context of these stock purchases also invites a closer examination of Matador Resources’ recent performance and market conditions. When insiders take direct financial stakes in their companies, it often hints at their conviction regarding strategic direction, operational efficiency, and growth potential. Moreover, such investments can bolster investor sentiment, potentially stabilizing stock prices or even catalyzing them upward.

In understanding the ramifications of Elsener’s stock purchase, it is essential to consider not only individual sentiment but also the broader implications for Matador Resources within the competitive landscape. As confidence from insiders translates to external perceptions, stakeholders may find both motivation and reassurance in the leadership’s commitment to the company’s future.

Overview of Matador Resources

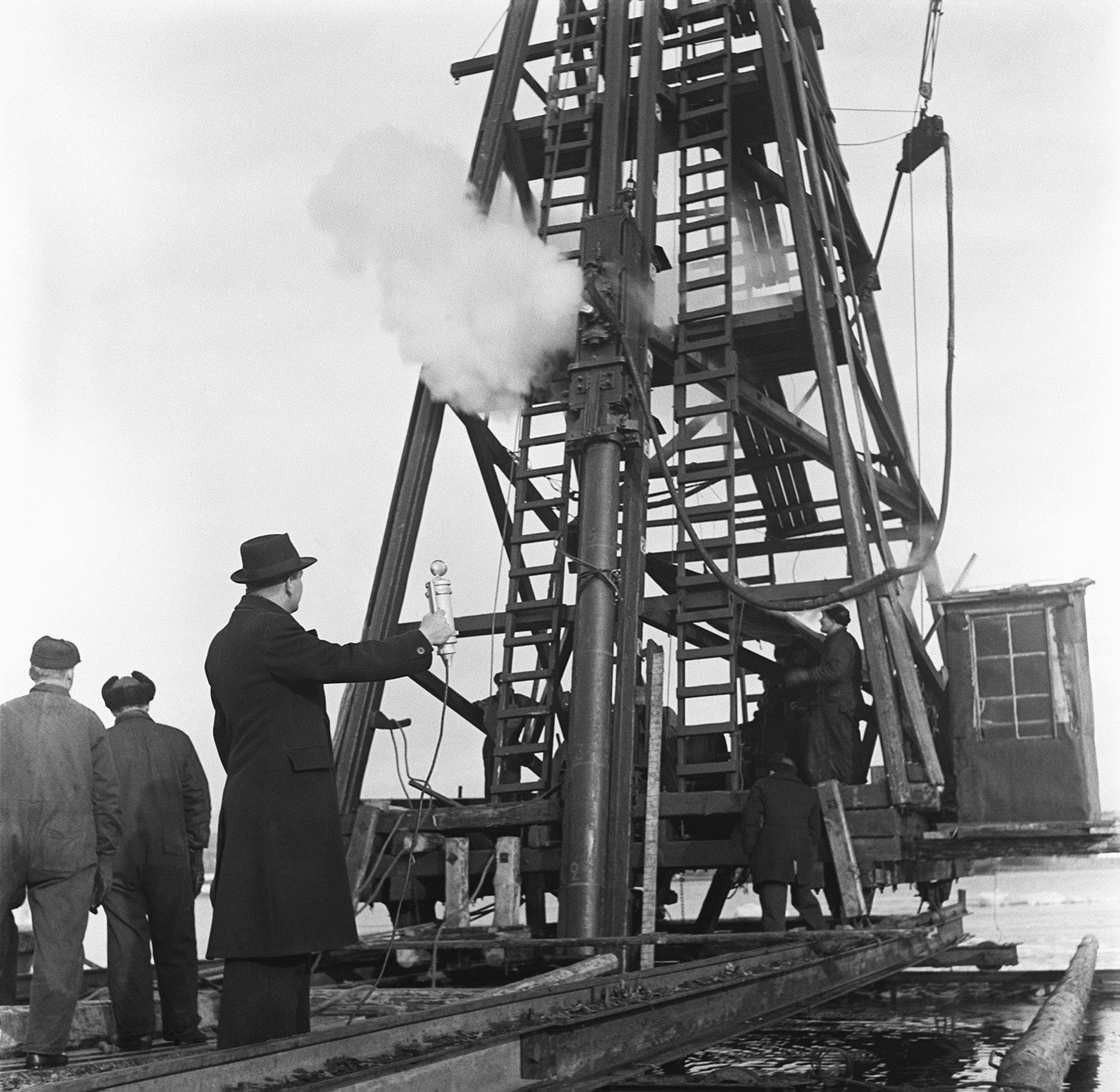

Matador Resources Company operates as an independent oil and natural gas exploration and production firm, prominently situated within the energy sector. Founded in 2003 and headquartered in Dallas, Texas, the company has strategically positioned itself in the thriving Permian Basin, which has emerged as one of the most productive oil regions in the United States. Concentrating on the exploration of crude oil and natural gas, Matador Resources has consistently proven to be an influential player in the energy market, characterized by a commitment to sustainable practices and innovation in extraction technologies.

In recent years, Matador Resources has experienced notable achievements that underscore its robust operational capacity. For instance, the company has reported significant increases in production volumes, fueled by the successful implementation of advanced drilling techniques and an expansion of its leasehold in the Permian Basin. Furthermore, Matador is recognized for its prudent financial management, evidenced by its ability to maintain a healthy balance sheet even amidst fluctuations in global oil prices. This financial stability allows the company to invest strategically in both infrastructure and technology, preparing it for future market challenges.

However, Matador Resources has also faced challenges, particularly due to the volatility inherent in the energy sector. The company must navigate regulatory pressures and the ongoing transition to renewable energy sources, which pose both risks and opportunities. Market dynamics, including fluctuating demand and supply chain disruptions, have necessitated a flexible approach to operations and investments. In this context, understanding the strategic decisions made by company executives, including high-ranking officials like William Elsener, is critical to appreciating how they position Matador Resources for continued success in an increasingly competitive and sustainable energy landscape.

William Elsener’s Role at Matador Resources

William Elsener serves as the Executive Vice President of Matador Resources Company, where he plays a pivotal role in shaping the company’s strategic direction and operational efficiency. With an extensive background in the oil and gas industry, Elsener brings a wealth of experience and expertise to Matador, which has positioned the company as a notable player in the exploration and production sectors. His leadership style emphasizes collaboration, fostering a culture of innovation, and operational excellence, which are essential for navigating the complexities of the energy landscape.

Prior to his tenure at Matador, Elsener held various key positions within other reputable firms, developing a strong foundation in financial management, strategic planning, and field operations. His educational background, combined with hands-on experience, has equipped him with the necessary skills to lead teams effectively, guiding them towards achieving corporate objectives. As Executive Vice President, his responsibilities encompass overseeing day-to-day operations, formulating growth strategies, and ensuring compliance with regulatory requirements, all while driving sustained profitability.

One of the critical aspects of Elsener’s influence within Matador is his ability to anticipate market trends and adjust the company’s strategy accordingly. His recent stock purchase of $30,075 signifies not only his personal commitment to the company’s long-term prospects but also reflects confidence in Matador Resources’ ongoing successes and future potential. Such strategic investments by senior executives can serve as an endorsement of the company’s vision and operational strategies, further motivating stakeholders and investors. As Matador continues to expand its footprint in the energy sector, Elsener’s leadership will remain integral to steering the company through evolving market dynamics and growth opportunities.

Details of the Stock Purchase

On October 15, 2023, William Elsener, the Executive Vice President of Matador Resources, made a noteworthy stock purchase that underscores his confidence in the company’s future. He acquired a total of 1,500 shares of Matador Resources at a price of $20.05 per share, resulting in a cumulative investment amounting to $30,075. This significant transaction is not only a reflection of Elsener’s personal investment strategy but also serves as a crucial indicator of his ongoing belief in the company’s long-term potential.

The timing of this acquisition is particularly relevant, as it occurred during a period of heightened interest in the energy sector, especially among companies involved in the exploration and production of oil and gas resources. By purchasing shares at this time, Elsener is signaling to the market a robust confidence in Matador Resources’ operational strategy and growth trajectory. This type of executive investment can often be interpreted positively by investors and analysts alike, as it suggests that key leaders believe the company is well-positioned for future success.

This stock purchase is also noteworthy in the broader context of corporate governance and executive accountability. When top executives invest their personal capital in their own companies, it often enhances investor trust and can lead to a reassessment of the company’s stock value. Such investments typically indicate that executives are aligning their personal interests with those of shareholders, potentially fostering an environment of shared success. Additionally, with Matador Resources continually focusing on optimizing production capabilities while navigating industry challenges, Elsener’s decision to invest at this juncture reinforces an optimistic outlook for investors considering their stakes in the company.

Implications of Insider Purchases

Insider purchases, such as the recent acquisition of shares by Matador Resources Executive Vice President William Elsener, play a significant role in shaping investor confidence and influencing market perceptions. When insiders choose to buy shares, it often signals their belief in the company’s future performance and prospects. This belief can lead to enhanced trust among investors, reinforcing the notion that company leadership possesses valuable insights and a favorable outlook regarding their business.

Historically, insider trading has been viewed through a dual lens—while it has the potential to boost investor confidence, it is also scrutinized for ethical considerations and potential conflicts of interest. In many instances, analysts interpret substantial insider purchases as a bullish indicator, suggesting that executives are aligning their interests with those of shareholders. For example, when an executive invests a significant sum, such as Elsener’s recent $30,075 purchase, it may indicate that they foresee increased value in the stock, prompting investors to reassess their positions. These purchases can create a ripple effect in the market, leading to increased demand for shares based on optimistic sentiments and perceived insider knowledge.

Moreover, market communication theories suggest that the timing and volume of insider trades may also influence perceptions. For instance, if multiple insiders are purchasing stock simultaneously, it could reinforce the sentiment surrounding a company’s positive trajectory. Conversely, when insiders sell shares, it typically raises red flags and could lead to increased scrutiny from investors and analysts alike. The current investment by Elsener adds a layer of credibility to Matador Resources, fostering a more favorable environment for potential and existing shareholders. Consequently, the implications of such insider purchases extend beyond individual transactions and can result in substantial shifts in investor behavior and market dynamics.

Market Reaction and Analysis

The recent announcement regarding Matador Resources Executive Vice President William Elsener’s strategic investment of $30,075 in company stock has attracted considerable attention from market participants. Following this disclosure, the immediate market reaction has exhibited notable fluctuations in both stock prices and trading volumes, highlighting a dynamic investor sentiment surrounding Matador Resources.

Upon the release of the news, the stock price for Matador Resources initially experienced a positive uptick, with shares rising by approximately 3% within the first hour of trading. This reaction can be attributed to the perception that insider purchases often signal confidence in a company’s future performance. Investors frequently view such actions as a strong indicator that management believes the stock is undervalued, thereby instilling a sense of optimism about the company’s direction.

Furthermore, the trading volume surrounding Matador’s stock increased significantly, with a noticeable spike immediately after the news was made public. This surge in activity often reflects heightened interest and could suggest that investors are anticipating more positive developments or financial results from Matador Resources in the near future. Analysts believe that strong insider buying can lead to a more favorable outlook, prompting both retail and institutional investors to reassess their positions relative to Matador’s stock.

Expert commentary from market analysts has also highlighted the potential implications of such investments. Several observers noted that insiders like Elsener have a deeper understanding of the company’s operations and market potential, which may enhance investor confidence. Moreover, the market’s initial favorable response could create a virtuous cycle, where increased stock demand further elevates Matador’s market valuation.

As the market continues to process this information, close attention will be paid to ongoing trading trends and any emerging analyst recommendations related to Matador Resources. This will provide a clearer picture of how investor sentiment is evolving in response to Elsener’s stock purchase and the overall market environment.

Long-Term Outlook for Matador Resources

As the energy sector experiences transformation in response to evolving market dynamics and regulatory frameworks, Matador Resources stands out for its strategic positioning within the oil and gas industry. This outlook considers various factors influencing the company’s future, including market trends, projected financial performance, and potential external challenges.

The global demand for energy continues to rise, driven by economic growth and the expansion of infrastructure projects. Analysts predict that the demand for oil and natural gas will remain steady in the coming decades, particularly as developing countries seek to advance their industrial capabilities. Matador Resources, with its robust portfolio of assets, is well-placed to capitalize on these trends. The company’s strategic focus on developing its strong acreage in high-yield regions contributes to an anticipated increase in production rates, which is vital for sustaining long-term growth.

Financially, Matador Resources has shown resilience, with projections indicating potential revenue growth in alignment with the expected increase in production. Continued investments in technology and operational efficiencies may further enhance profitability and cash flow generation. Notable financial metrics, including revenue forecasts and profitability ratios, suggest a positive trend that is critical for maintaining shareholder confidence.

However, the company’s forward-looking performance is not without challenges. External factors such as fluctuating oil prices, geopolitical tensions, and potential regulatory changes may pose risks to operational stability and profitability. Furthermore, environmental concerns and the ongoing transition to renewable energy sources could impact the long-term sustainability of fossil fuel investments. Matador Resources must navigate these complexities while maintaining a proactive strategy that adapts to changing market conditions.

In conclusion, the long-term outlook for Matador Resources appears promising, driven by strong market demand, solid financial performance, and strategic asset management, although the company must remain vigilant against external challenges that could influence its trajectory. The recent investment by EVP William Elsener underscores confidence in the company’s future potential amidst this multifaceted landscape.

Comparative Analysis with Other Executives’ Actions

To understand the implications of William Elsener’s recent stock purchase of $30,075 in Matador Resources, it is essential to examine similar insider trading activities within the energy sector. Through evaluating these transactions, one can determine whether Elsener’s actions are in line with broader market trends among corporate executives. Such comparisons provide valuable context that can influence investor sentiment and perceptions of corporate governance.

In recent months, several executives in the energy sector have made notable stock acquisitions, signaling confidence in their respective companies. For instance, the CEO of a leading oil and gas firm recently invested $50,000 in his company’s stock after a robust quarterly earnings report, suggesting that insiders are generally optimistic about the future. This trend captures the attention of market analysts, as insider buying often indicates a firm belief in the strength and stability of a company’s performance. Similarly, another executive at a prominent renewable energy firm purchased shares amounting to $40,000, aligning with the growing interest in sustainable energy investments.

When comparing these actions with Elsener’s investment, it becomes evident that his $30,075 stock purchase represents a strategic commitment to Matador Resources. The energy sector has experienced fluctuations due to market conditions; however, insider buying can serve as a barometer of executive confidence. Analysts often regard these actions as forward-looking, suggesting that those who are most informed about a company’s internal dynamics foresee positive developments. Therefore, Elsener’s decision mirrors a cautious optimism seen among his peers and may reinforce Matador Resources’ standing in an ever-evolving industry landscape.

Conclusion

In summary, William Elsener’s recent purchase of $30,075 in Matador Resources stock highlights a significant moment for both the company and its investors. This strategic investment not only underscores Elsener’s confidence in the company’s future prospects but also reflects a broader trend where insiders choose to align their financial interests with that of shareholders. Such insider trading activity can often be seen as a positive signal, suggesting that those with intimate knowledge of the company’s operations and trajectory believe in the underlying value of their investments.

Furthermore, analyzing stock purchases made by corporate executives can provide insight into the market’s potential direction. In this case, Elsener’s acquisition may indicate forthcoming developments in Matador Resources that could strengthen its financial position and market performance. As the energy sector continues to adapt to fluctuating demands and increasing focus on sustainable practices, keeping track of insider transactions like Elsener’s becomes essential for investors looking to make informed decisions.

As stakeholders consider the implications of this transaction, it is crucial to contextualize it within the larger framework of the energy industry’s evolving landscape. Investing in companies like Matador Resources not only offers potential financial rewards but also positions investors to participate in a sector poised for significant transformations. Future developments should be monitored closely, as they may influence both the company’s trajectory and the respective stock performance.

Thus, keeping an eye on Matador Resources and similar companies, particularly following insider investments, can equip investors with valuable insights as they navigate the complex field of energy investments.