What is a Stock Split?

A stock split is a corporate action where a company divides its existing shares into multiple new shares, effectively increasing the total number of shares while maintaining the same overall market capitalization. For example, in a 2-for-1 stock split, each shareholder receives an additional share for every share they hold, resulting in the total number of shares owned doubling. However, the price per share is also halved, ensuring that the total value of the investment remains unchanged. This mechanism is commonly employed by companies seeking to make their stock more affordable and appealing to a broader range of investors.

There are several reasons why companies initiate stock splits. One of the primary motivations is to adjust the share price to a more attractive range. High stock prices can deter potential investors, especially retail investors, who may find it challenging to afford whole shares. By reducing the nominal price of the shares through a split, companies can enhance liquidity and increase trading volumes, ultimately promoting more active trading in their stocks. Additionally, a stock split can create a perception of growth and success, as companies with rising share prices may split their stocks to signal that they are advancing in a positive direction.

While a stock split does not alter a company’s market capitalization, it can have various effects on share prices. In some cases, the announcement of a stock split might lead to an increase in the stock price as investors respond favorably. Historical examples of notable stock splits include those by technology giants like Apple and Google, which have successfully leveraged splits to enhance their stock’s accessibility. As investors consider the implications of a stock split, it is essential to understand not only the mechanics of the action itself but also its potential impact on the market. This understanding lays the groundwork for discussions about the specific stock split involving AVGO and its significance in the current investment landscape.

Overview of AVGO and Its Recent Performance

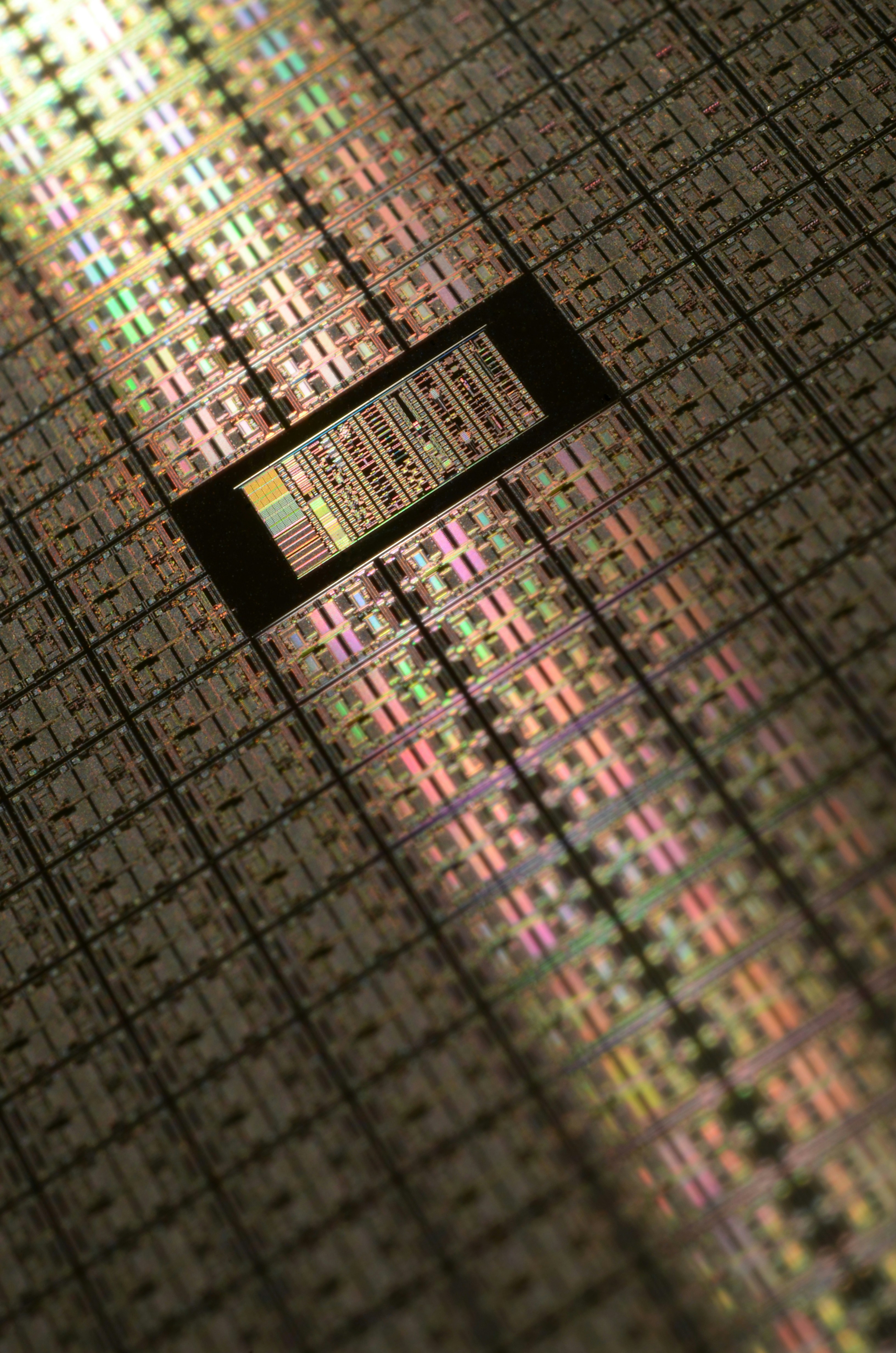

Broadcom Inc. (AVGO), a global technology leader, specializes in semiconductors and infrastructure software solutions. The company plays a critical role in various industries, including telecommunications, data center, and enterprise applications. Broadcom’s diverse business model allows it to provide a wide range of products, such as networking, broadband, and storage solutions. This versatility positions AVGO favorably in an increasingly digital economy, enabling the company to capitalize on the growing demand for connected devices and advanced technology.

In recent years, Broadcom has demonstrated consistent financial performance, showcasing its ability to adapt to market shifts and capitalize on emerging trends. For instance, the company reported significant revenue growth driven by its expansion into newer technologies, including 5G and Wi-Fi 6. These advancements have not only bolstered AVGO’s product offerings but have also increased its market competitiveness. The successful launch of cutting-edge products has been well-received by investors, further solidifying the company’s reputation as an industry powerhouse.

As of late 2023, AVGO’s stock performance has been closely monitored, particularly in light of its anticipated stock split. Factors influencing this decision include the overall market climate and investor sentiment surrounding technology stocks. A favorable economic environment, characterized by increased public interest in tech investments, has led to a bullish outlook for Broadcom. Additionally, announcements regarding partnerships and acquisitions aimed at enhancing its technology capabilities have contributed to positive investor perceptions. Such developments not only reflect AVGO’s commitment to sustainable growth but also highlight the company’s proactive approach to remaining competitive.

Implications of the AVGO Stock Split for Investors

The AVGO stock split has significant implications for both existing shareholders and potential investors. A stock split is an event whereby a corporation divides its existing shares into multiple new shares, resulting in a proportional reduction in the share price. One immediate effect of the AVGO stock split is the potential enhancement of liquidity. As the share price becomes more affordable following the split, it may attract more investors who were previously priced out of the market. This increase in trading volume can lead to greater market activity and possibly more stability in stock price movements.

Investor psychology also plays a crucial role in the aftermath of a stock split. Historically, stock splits can create a perception of growth and optimism. Investors may interpret the AVGO stock split as a sign that the company anticipates strong future performance, stimulating interest and fostering a positive market sentiment. This perception can lead to increased buying activity, as both current shareholders and new investors might view the adjusted share price as an enticing entry point.

From an analytical perspective, the response to the AVGO stock split can vary. Analysts often assess such events based on historical data, noting that companies initiating stock splits typically experience price appreciation in the near term. However, while a stock split may not inherently increase the company’s value, it can serve as a signal of confidence from management regarding the company’s prospects. Therefore, whether analysts perceive the AVGO stock split as a positive indicator can significantly influence future stock performance. Understanding these implications is essential for investors as they navigate their investment strategies in light of the recent changes in AVGO’s stock configuration.

Tips for Investors Following the Stock Split

The stock split of AVGO presents both opportunities and challenges for investors, necessitating a thoughtful approach to navigating the post-split landscape. One of the primary considerations is stock valuation. Following a split, it is essential for investors to reassess the value of AVGO shares, as the split could influence market perception and pricing. It’s prudent to evaluate price-to-earnings ratios, cash flow, and other relevant metrics to determine whether the stock remains a strong investment opportunity.

Thorough research is paramount for investors looking to capitalize on the stock split. Investors should examine AVGO’s historical performance, emphasizing its earnings trajectory and market trends. Additionally, analyzing the company’s competitive positioning within the semiconductor sector can yield insights into its growth potential. Keep an eye on broader economic indicators and trends that may affect tech stock performance, as these can significantly influence AVGO shares post-split.

Furthermore, adopting a long-term investment strategy can be advantageous when navigating the implications of a stock split. Investors should focus on fundamental strengths and potential growth catalysts rather than short-term volatility. By maintaining a long-term perspective, investors can better comprehend AVGO’s trajectory and its role in the investment portfolio.

Timing the purchase or sale of AVGO shares can also be critical. Post-split fluctuations may create temporary opportunities, but investors should avoid making impulsive decisions based solely on short-term market movements. Observing market trends and quantifying any unmet potential can assist in making informed transactions. Keeping abreast of industry news and company updates will provide investors with the necessary context for decision-making.

In conclusion, approaching the AVGO stock split with a clear strategy that incorporates meticulous valuation assessment, diligent research, and a focus on long-term goals will equip investors to make well-informed decisions adjusted to the evolving market landscape.